The ramifications of student debt

Stepping into the academic world means so much more than just obtaining a decent grade these days. It’s not just essays, lab reports and mid-term exams that students have to deal with when they move into a new university town. Financial constraints — no matter how big or small — and increasing rising student debt, due to high tuition costs, can have a huge impact on student well-being, especially in a province with the highest tuition costs in Canada.

And students at Wilfrid Laurier University are no exception.

With OSAP numbers rising and students taking on part-time, even full-time, jobs during their studies, academics can be heavily impacted. And why work so much to pay for an education where you can only get the grades you don’t want?

“Obviously for students who are struggling financially, they have to work more — more than they ever have previously,” explained Rylan Kinnon, the executive director at the Ontario Undergraduate Students’ Alliance (OUSA).

For the past year OUSA has been lobbying for a tuition freeze for next year, to ensure affordability for students.

However, with the original tuition framework slated to increase at five per cent a year, OUSA, along with other student groups, were successfully able to lobby for a 3 per cent tuition

increase for the next couple of years rather than five.

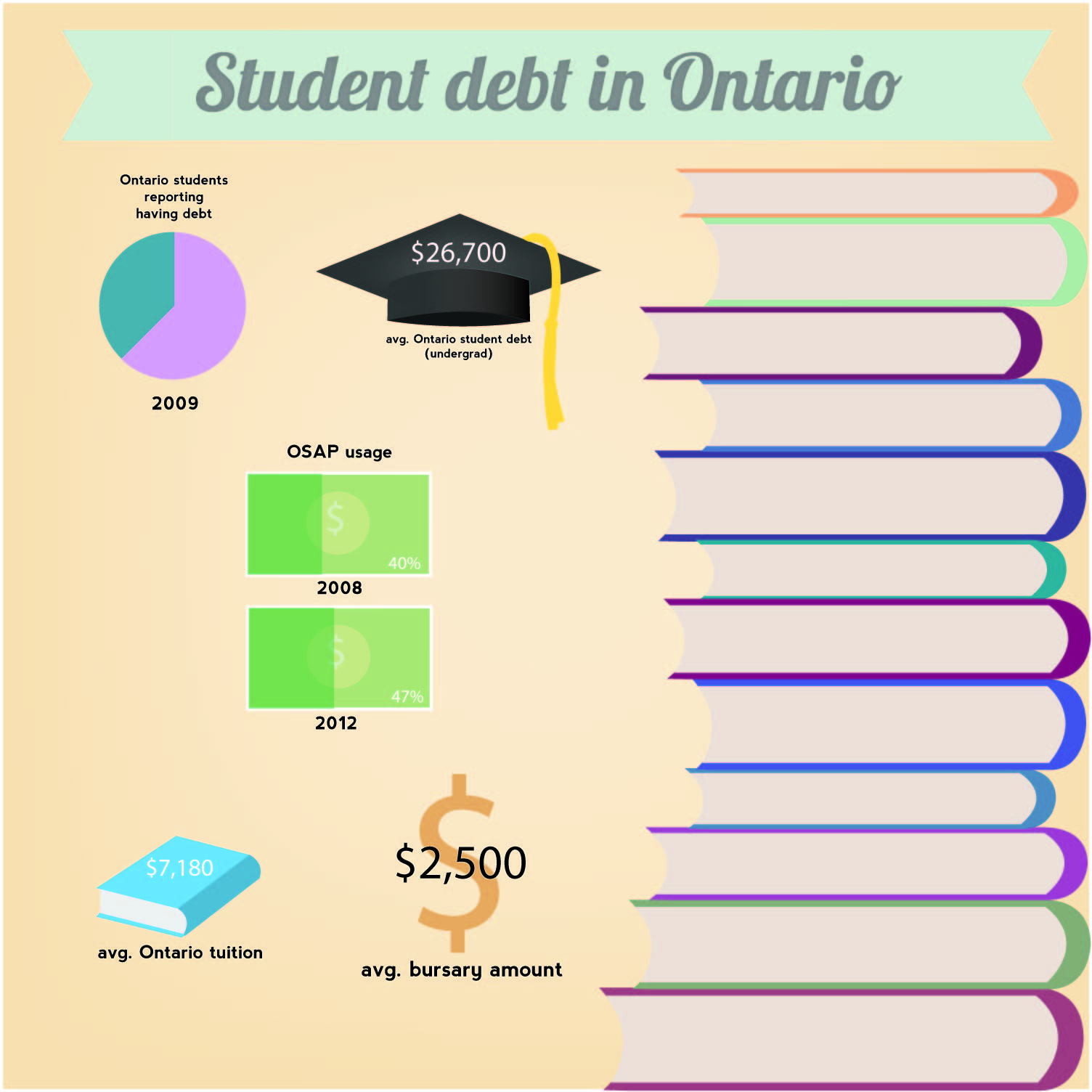

But Ontario will still be faced with soaring tuition costs. The average tuition cost in Ontario in 2012 was $7,180. The national average is $5,581.

According to Kinnon, the average undergraduate student debt in Ontario was $26,700. He added that around 64 per cent of students from Ontario noted they were dealing with debt during or post-graduation.

“We had been lobbying for a tuition freeze, for at least one year, and beyond that one year we wouldn’t want to see tuition increase any more than inflation,” added Kinnon.

Even if a student is working at a co-op placement, it could take up to eight weeks of work to make enough money for tuition, according to Waterloo Banking Project director, Ryan Chen-Wing. In 1985, that would’ve taken two weeks.

But there are other factors when it comes to financial concerns in addition to tuition and university fees. Food, rent and other expenses have a tremendous impact.

Even further, the high cost of post-secondary education can deter students from even attending all together, a situation that can be seen in those who have lower incomes. This is an issue that sometimes impacts the Aboriginal population in Canada as well international students.

Seeking financial aid

The use of OSAP is increasing and with the potential of decreasing provincial funding in later years, the prevalence of OSAP and other student financial aid may be greater.

According to OUSA’s report on the tuition framework, OSAP use increased from approximately 40 to 47 per cent between 2008 and 2012. But that’s not the only thing available to students. The 30 per cent Ontario tuition grant and various student financial aids, whether that is a bursary, scholarship or an award, are other opportunities to fund one’s education.

The knowledge of such things isn’t common among students, however.

“Knowledge of student financial assistance is not that great, and I think this can be a big contributor to student concerns about debt and their future prospects,” continued Kinnon. “The government needs to do a better job explaining to the public what financial resources are available.”

Laurier students should take note that there is more financial aid than ever available to them.

According to the student awards office, the average bursary four years ago was about $1,500 and this past year that number had risen to $2,500. The amount of money available to students has been up in recent years, largely due to enrolment.

“In terms of the amount of money that’s available to students — as long as our enrolment keeps going up, we will see an increase in the amount of money in the tuition set aside fund, which is mandated by the government.” explained Laurier’s associate registrar of student awards Ruth MacNeil.

With respect to national averages, Laurier students, according to the student awards office, were a bit above the average and default rates were slightly below the average, which Ruth MacNeil explained, is a good thing. This means that while more and more students are applying for OSAP, fewer students are defaulting on their loans.

And this is not just a typical trend for OSAP. The increase in applications is staggering.

“From 2004-2005 to last year our OSAP population has gone up 210 per cent,” added MacNeil. “So we’ve more than doubled the number of students applying for OSAP funding.”

Effectively, that number is inflated due to students in the past couple years applying for the Ontario Tuition Grant.

Students applying for the grant have to apply through OSAP even if they are not receiving any OSAP funds. However, despite the inflation, the increase is nevertheless dramatic.

Although OSAP is the most common, there are other methods of obtaining financial aid that should be explored. Ruth MacNeil emphasized that students should look further than only OSAP if they hope to get the most financial aid possible.

“If you qualify for full OSAP funding… there’s still a gap of about 3000 dollars between what you’re going to receive in OSAP and what you’re actually paying for your university. You should be applying for bursary assistance when the emails go out from our office. You should be applying for scholarships. [Students] have to realize it’s a package. It’s not one plan that’s going to get you to the finish line.”

Impact of university finances

“There’s no budget cuts looming right now,” explained Ray Darling. “It’s just speculation right now. I think that speculation is always there, that budget cuts are looming.”

Darling suggests the perpetual feeling of looming budget cuts stems from the situation in the provincial government and that Integrated Planning and Resource Management (IRPM) is in place if ever budget cuts become a reality.

Laurier’s IPRM initiative, according to the university, will identify academic and administrative priorities of the university and determine how to run and fund these priorities with available resources.

“What IPRM is supposed to do,” continued Darling, “is prepare us so that when cuts come we will have identified academic and administrative programs that we can enhance and some that could possibly be eliminated.”

While tuition increases are locked in at 3 per cent year, it’s currently unknown what the impact will be financially and academically .

Communication and understanding

A key issue facing students and faculty is breaking down communication barriers so students can discover the services available to them, and the university can offer services that accurately address financial needs. Identifying the problem is one step, but addressing the problem is a very difficult second.

Darling, who also happens to be a political science professor, has the unique position of being both an administrative staff and faculty member. Darling acknowledged the benefits of interacting with students in two very different capacities.

“It’s one of the reasons I teach is I think it makes me a better administrator,” he said. “Because I am in the classroom with students on the front lines.”

Despite the efforts of professors and administrative staff, students have mixed opinions on the depth of understanding university faculty have of student financial constraints and stresses. Sometimes students will need extensions or need to defer exams due to an increasing work load.

Fourth-year Laurier economics student Michael Sipidias has had a generally positive experience with professors in this capacity. He explained, “I think they do understand. At the end of the day it’s our issue and they [professors] can only sympathize so much.”

Even though she acknowledged that students are responsible for their own finances, fourth year sociology and psychology student Lea Thoman is frustrated at how some professors simply fail to understand certain situations.

“I feel like they just think we’re all fine and if we’re there then we found a way to make it work. But they don’t understand in the years to come after we graduate how stressful it is to pay back all your debt,” she said.

But, according to fourth-year communications studies student, Michael Kates, it also depends on your priorities as a student when it comes to work and your studies.

“It really just depends on your priorities. If making money during your eight months of school is a priority, you’re going to make time for it,” he said. “Maybe it’s about taking that first step to try and see if you can work and if you can’t you can’t. But at least you tried.”

If students are looking to professors for anything more than understanding and an extension, they should go to those best equipped to address their concerns.

Professors are often approached with a variety of questions and problems, some of which relate to academics while others are financially related.

However, professors are not experts in financial aid or student debt. So what should they do when inevitably approached by students with financial concerns?

“What we do want them [professors] to do is to tell the students, if you’re suffering financially, go to this office. That’s what we want to evolve towards. It’s already available but we want to do more counseling for students. Where we want to go next is offering more financial aid advising for students.”

Waterloo Banking Project, an organization that assists both University of Waterloo and WLU students in financial planning in the hopes that students come out more financially sound when they’re done their degree.

“Our purpose is for graduates of our schools to graduate in a better financial situation, so we talk about graduating reaching, graduating with more money and less debt,” explained Chen-Wing.

To Chen-Wing, planning is paramount when in comes to decreasing the level of financial distress that students often face. When most students come to university, they don’t have a plan in motion.

“Generally students come to the term with some money, it may not be enough, and it’s important that they know that at the beginning of the term and it’s also important that they have the financial support that they need when it’s close to the end of the term,” he explained.

Chen-Wing added, “In September, you should know that you’re going to be in trouble in November, then you can change your behavior.”

Jimmy Liao, a Laurier Brantford student, echoed the remarks made by Chen-Wing.

“Coming into university you kind of don’t have a sense of what your financial status is, how much money you should spend on this — basically budgeting. All those alcoholic beverages and food, covers for events, all those things add up really quick,” Liao explained.

There is no quick remedy to the student financial situation for post-secondary education in Ontario, but there is short-term relief.

And sometimes it’s up to the students to actively seek out such relief.

“I suggest really hitting up financial aid offices. They’re super nice, super helpful. Go on the Internet and search up any student awards,” concluded Liao.